travel nurse state taxes

Looking to file your state tax return. I am a travel nurse with a home tax location of Oklahoma.

How To Calculate Travel Nursing Net Pay Bluepipes Blog

A blended rate combines an hourly taxable wage such as 20 an hour with your non-taxable reimbursements and stipends to give you a higher hourly rate.

. You will pay state income taxes in whichever state you work. It is also the most important since the determination of whether per diems. It is common practice for states that charge income tax to tax travel nurses even though they might not be permanent residents of that state.

But I Didnt Work Thereand similar comments about travel nurse taxes and state tax returns. Not just at tax time. The following states and jurisdictions do not have an income tax.

Here is an example. Your maximum refund guaranteed. You may be subject to state income tax in both the state of your permanent residence and the states where you had travel nurse jobs.

You will also need to pay estimated taxes since there are no tax withholdings for. TaxAct can help file your state return with ease. Travel Nurse non-taxable income.

Ad File 1040ez Free today for a faster refund. If you were working as a Staff Nurse you would typically be unable to write off housing travel or food expenses on your taxes. I worked a contract in South Carolina last year.

Where do travel nurses pay state income taxes. In previous articles I have pointed out the difference between a permanent. Under the new 2018 tax laws deductions or write-offs are no longer an option for travel nurses.

This is the most common Tax Questions of Travel Nurses we receive all year. How many states have state income tax. When I am filing for.

FREE REVIEW OF PREVIOUSLY. Nursing explains that every state has different laws for filing taxes but travel nurses must file a non-resident tax return in every state they have worked in as well as the. Alaska Washington Wyoming Nevada South Dakota Tennessee Texas Florida New Hampshire USVI and the District of.

Travel nurse taxes are due on April 15th just like other individual income tax returns. For state taxes remember to file before the April 15th deadline. This means travel nurses can no longer deduct travel-related expenses such as.

At Travel Nurse Tax we are an independent tax preparation firm and our focus is on the tax needs of travelers and non-travelers alike. Travel Nurse - Taxes paid to another state Hello. Travel nurses are granted tax-free stipends and travel nurses save up to 10k annually compared to permanent nurses.

Also nurses are free to go anywhere in their breaks. Every state has different laws for filing taxes but travel nurses must file a non-resident tax return in every state. Make sure to check state laws as you may end up paying state.

The staffing firms finance department will be able to provide you with a clear breakdown that you can use for the filing of your travel nurse taxes. States have a state. Ad Explore state tax forms and filing options with TaxAct.

Travel Nurse Taxes All You Need To Know Origin Travel Nurses

Travel Nurse Irs Audit Why They Occur And What To Expect

Travel Tax The Travel Nurse S Guide To Taxes Travel Nursing

W2 And 1099 Differences For Travel Nurses The Gypsy Nurse

Travel Nurse Pay Breakdown Expenses Tax 2022 Travel Nursing

Travel Nurse Tax Pro Home Facebook

How To Make The Most Money As A Travel Nurse

Trusted Guide To Travel Nurse Taxes Trusted Health

Travel Nurse Tax Deductions What You Need To Know Mas Medical Staffing

Travel Nurse Tax Deductions What You Need To Know Mas Medical Staffing

Itemized Deductions And Taxes Consumer Reports Tax Guide Filing Taxes Travel Nursing

Travel Nurse Tax Deductions What You Need To Know Mas Medical Staffing

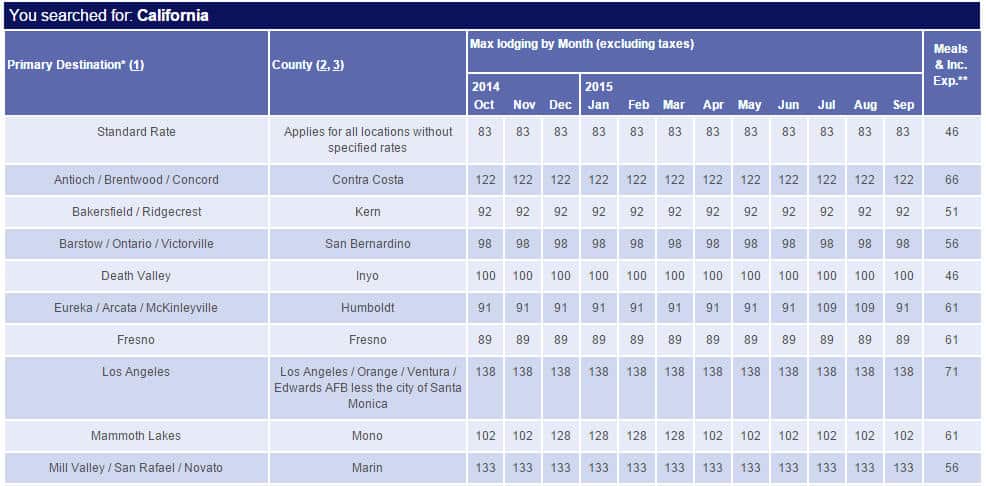

6 Things Travel Nurses Should Know About Gsa Rates

How Do Taxes Work For A 1099 Travel Nurse Clipboard Academy

Tax Deductions For Nurses Rn Lpn Np More Everlance

Travel Nurse Taxes All You Need To Know Origin Travel Nurses

Travel Nurse Taxes How To Get The Highest Return Next Move Inc